In 2022, my students experienced a life-altering government policy change related to their student debt. I used their experience to engage them in connecting our studies of debt inequalities to concrete solutions.

As a professor teaching inequality, I’m used to my students asking, “When will we talk about solutions?” While I do always address solutions ranging from policies to social movements, students are often looking for something more concrete. In Fall 2022, students in Racial Wealth Gap: Black Debt, White Debt (cross listed from African American Studies), students experienced a monumental, life-altering policy enactment—and then the emotions that came with that policy’s suspension under legal challenge.

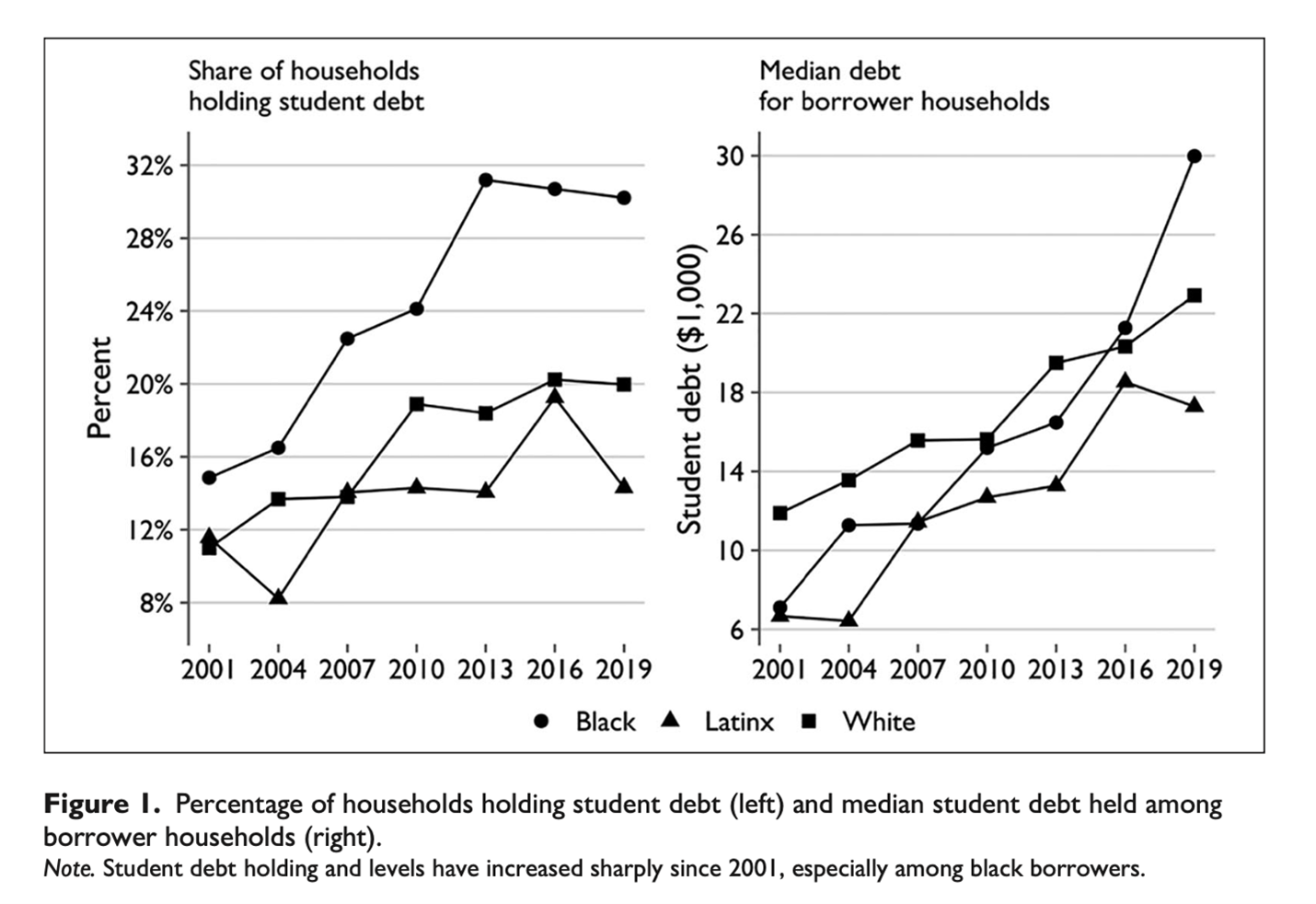

One line of my research has covered student debt and its harmful effects on students before and after they leave higher education. With sociologist Raphaël Charron-Chénier, I focused on how marginalized students experience higher education on terms that undermine the benefit of inclusion, an example of “predatory inclusion.” In particular, student debt hits black student borrowers harder. Notice in the graphs below that the line for black borrowers has shot much higher than for other student borrowers.”

As an instructor, I was painfully aware of debt’s harmful effects playing out in my classroom. I saw growing overwork in school and employment, pressure to choose the “right” major, stress and uncertainty about their future. (I used those experiences with students to frame a discussion with Tressie McMillan Cottom on the Ezra Klein Show podcast in 2021).

Just before arriving at Iowa, I had worked with a small team of sociologists to help shape Senator Warren’s proposal for student debt cancellation. We had suggested canceling $50,000 to be the most equitable and beneficial amount. Over the next few years, I participated in public, policy and academic discussions explaining the student debt crisis, its relationship to racial wealth inequality, and the impact of student debt cancellation.

My course on racial inequality in debt and wealth dynamics already covered our work in a student debt module, illustrating how class insights and concepts could apply directly to potential policy. That module took on real-world significance when, in our first week of class, President Biden announced he would be cancelling up to $20,000 in student debt per borrower in light of the pandemic’s impacts on student finances. We often talk about giving students opportunities for “experiential learning” outside the classroom—in this case, the opportunity found us.

Students’ discussions with friends, classmates, and family members became sociological insights for us to process together. From those conversations, we soon realized current students needed more information on the policy change. Many of my students had not realized they were eligible as current students (anyone who had taken on federal loans as of June 30, 2022, could potentially receive relief). With relatively little information forthcoming from government or institutions, it seemed like a great opportunity for students to come together and share information with peers and community members, and to make this important moment a more collective experience. I proposed an alternative final project: an informational campaign about student debt relief. Students unanimously accepted the challenge. The campaign would include informational tabling and assistance signing up and exhibits for students, faculty and staff to record their thoughts and feelings around the policy; informational flyering; background research to support the other activities; and “project historians” documenting the process.

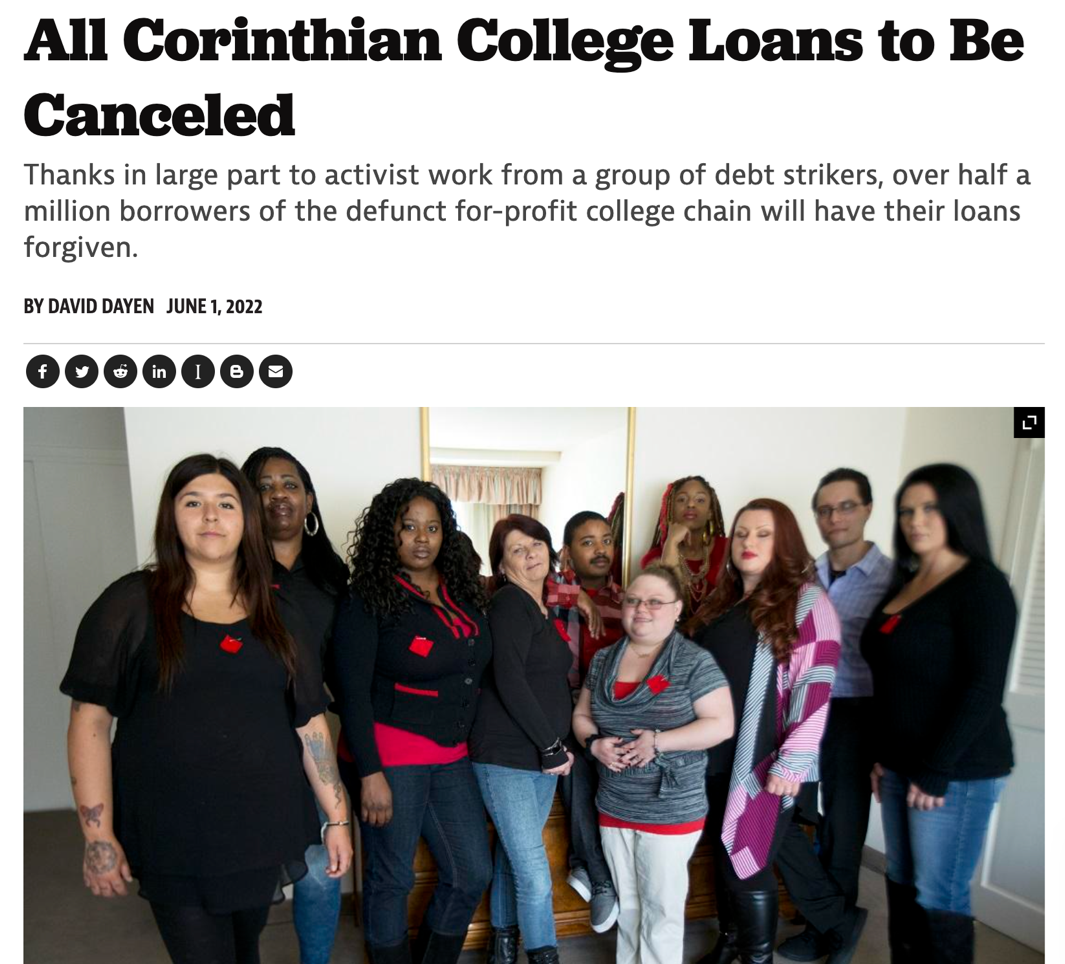

Current events and students’ questions guided our discussions of concepts, research and background on the structure of federal student debt and governmental processes. We addressed topics like means testing, and how requiring borrowers to fill out a form could exclude eligible people (drawing from the recent scholarship of sociology professor Victor Ray); the structure of federal student debt, and who has authority to waive or modify it; and our work modeling the impact of student debt cancelation. We also covered the movement for student debt cancelation, beginning with the “Corinthian 15,” whose strike against their debt associated with predatory for-profit schools, which had provided the precedent for broader debt relief.

Only rarely do we researchers get a chance to influence real policy, much less directly witness its positive effects. As the program started to take shape, students documented their feelings of excitement, hope and fear. They wrote eloquently about how student debt had already shaped their lives. Even my career advice sessions in office hours went differently, with students able to imagine a different career path not haunted by debt payments. To my students, the significance of debt relief went far beyond the dollar amount. It signaled that a problem that hounded them and their peers could be solved through government action. For once, they felt seen.

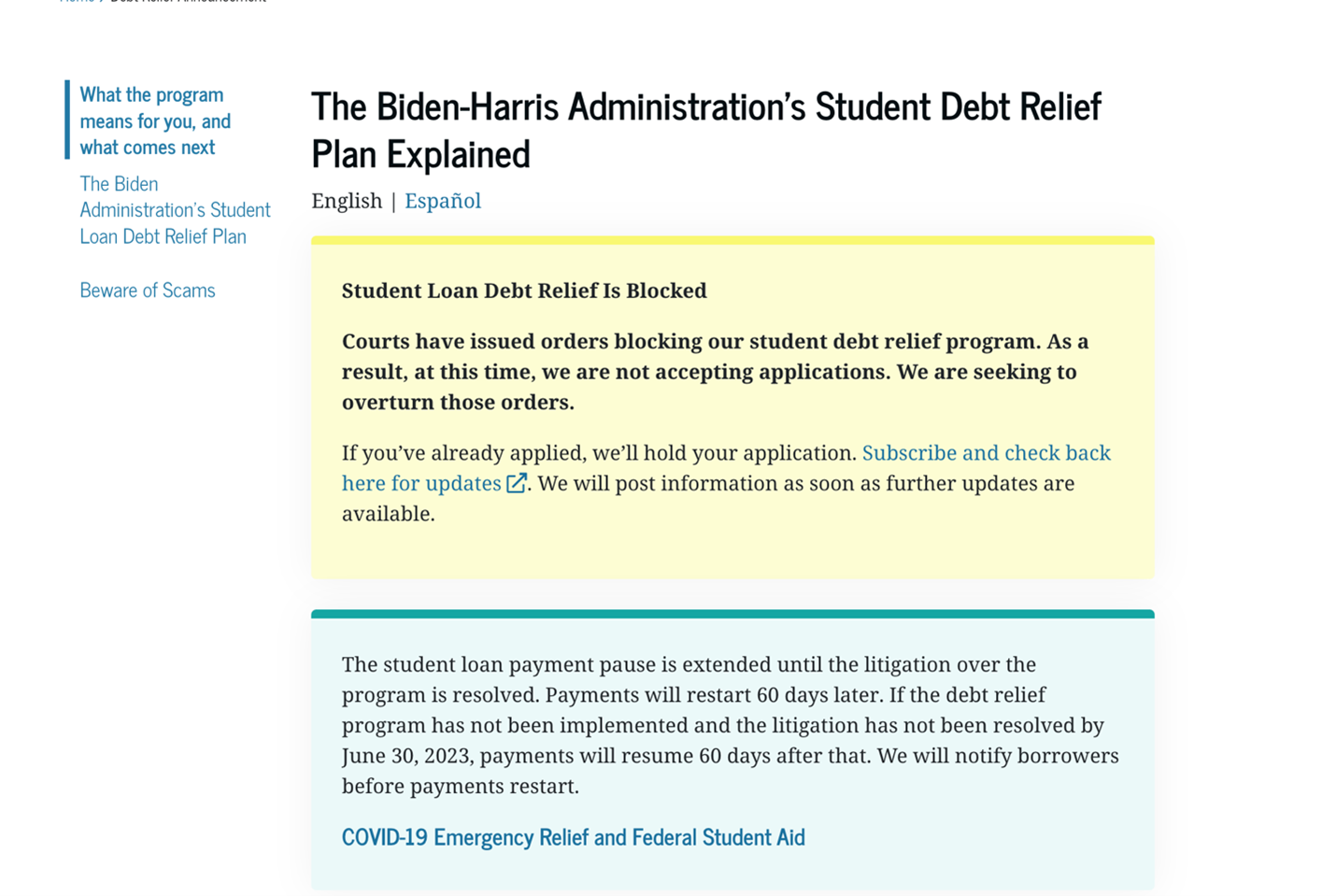

Then came the legal challenges. In response to several lawsuits, the Department of Education first paused distribution of relief to the millions of borrowers who had been approved, then halted signups altogether. As of late March, Federal Student Aid’s website on student debt relief, still looks like this:

While I had warned students that our project might have to pivot, it was still a hard blow. Some students expressed the sentiment that “I knew it was too good to be true.” While difficult both logistically and spiritually, this was an important lesson in real-world policy work—the ground sometimes shifts beneath your feet. We quickly took stock to assess what components of the campaign could be salvaged. Almost everything, it turned out, except actually helping people sign up for relief. Students rallied and conducted research, created flyers, and collected testimonies from classmates. They also grilled me for information on the legal challenges headed to the Supreme Court, and who was standing against Biden’s program. One question that stuck with me: “Why are they so threatened by debt relief?”

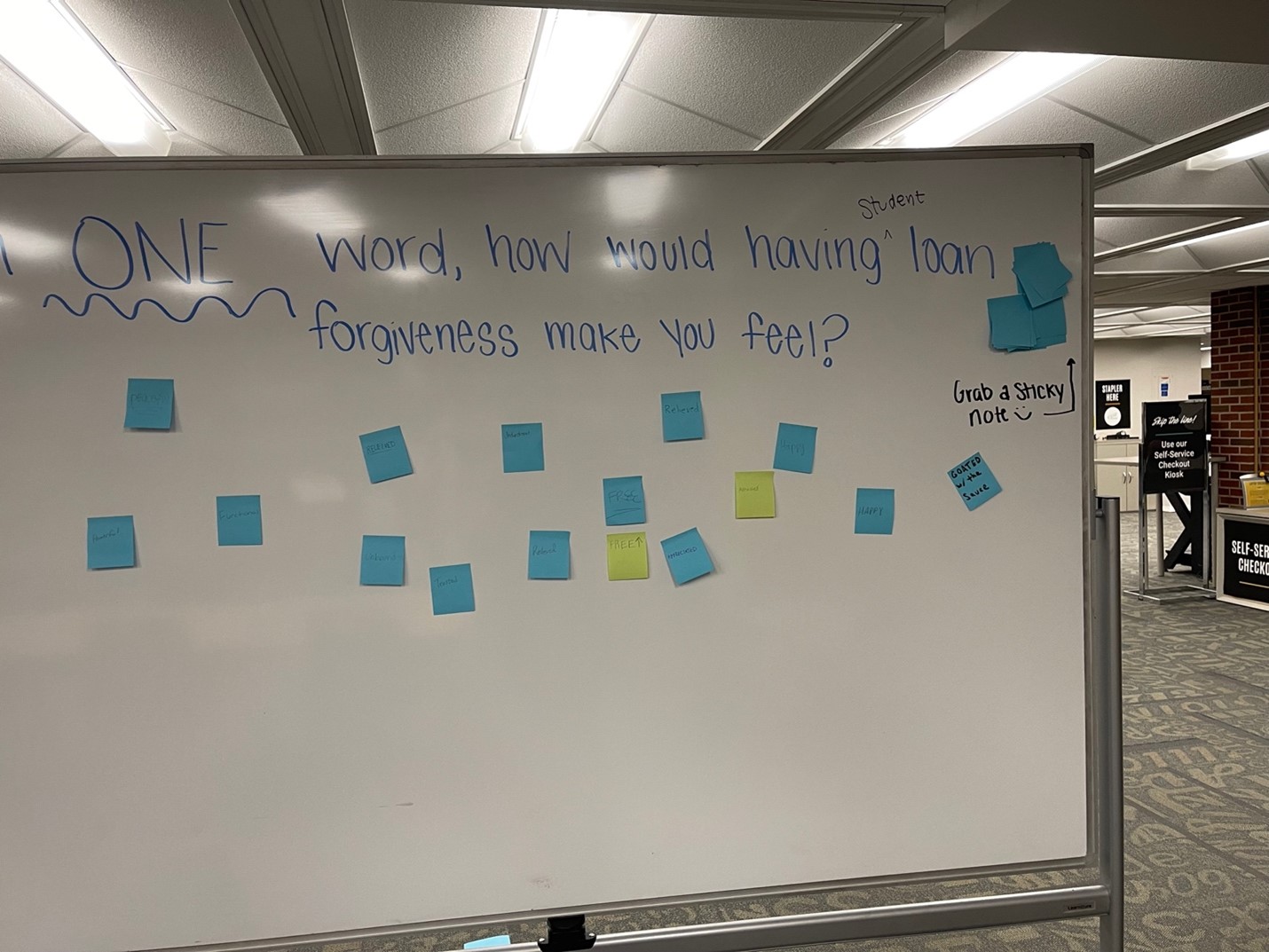

Despite our slimmed-down structure, students saw the transformative potential of this program on their own peers. One component of the final project involved a board placed in the library for students to respond to prompts. On one side of the board, students recorded how much debt they’d have remaining after debt relief. On the other side, my students asked their peers: “How would student debt forgiveness make you feel?” The responses: “Free.” “Relieved.” “Powerful.” “Peaceful.” “Trusted.” “Happy.” “Appreciated.” “Unbound.” “Understood.” “Alleviated.” “Functional.” And finally, “GOATed with the sauce.”

Although debt relief is still in limbo (with arguments heard in the Supreme Court in February 2023), my students better understand importance of current policy and advocacy for the issues that matter to them. Speaking for myself, that glimpse into the universe where my students can graduate free from debt made me even more motivated to document the impact of debt and the need for reform. My students were hugely disappointed by the postponement of relief. But through our project, they could see the benefit of talking about these large-scale policies’ effects on their lives, whether in joy or dismay, and to imagine possibilities together.

Whether enrolled in The Racial Wealth Gap or not, our students have just taken part in a major moment in higher education history. I’ll close with the words of student Georgia Page, asked to reflect on the debt relief campaign:

Getting to research the impacts and implementation of student debt relief greatly shifted my understanding as to how funding of higher-education impacts life outcomes, particularly for Black and Brown students. For students who do not have access to generational wealth, there is no equitable way of financing expensive higher-education. Working alongside a team, I got to see how these realities impact students on our campus, and the overwhelmingly positive responses we received in regards to student-debt forgiveness showed me how immediate relief would serve our community.